How to Calculate COBRA Cost

Understanding COBRA premiums starts with knowing you're covering the full cost of your employer-sponsored health plan. But rather than make assumptions, you can estimate your COBRA costs on your own by using the COBRA Cost Calculator or looking at your last year's W-2.

Find Out How Much Your Monthly COBRA Premium Will Be

If you need to continue health coverage through an employer, the COBRA monthly cost is based on the full amount paid for health insurance under the original employer's plan. This includes not only what was previously paid by the individual responsible for the insurance but also the employer's contribution.

Estimate Only

To get an exact quote on continuing your employer plan, you should contact the plan administrator or refer to the COBRA enrollment paperwork you received regarding enrollment.

COBRA Cost Calulator

Our COBRA Premium Cost Calculator estimates your monthly premium by based on a combination of their insurance deduction, the employer's contribution and the pay frequency. Some employers might add an administrative fee. It accounts for an optional administrative fee (up to 2%).

Is COBRA Too Expensive?

COBRA health insurance premiums can be surprisingly high because you’re responsible for the full cost of your health plan—including the portion your employer previously covered.

Other Options for Health Plan Coverage

Get started with temporary medical insurance to cover a gap between employer-sponsored plans. By comparing term health plans you may find an option that fits your needs and budget, while helping you avoid the risks of going uninsured.

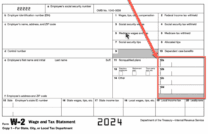

Use Last Year's W-2

Keep in mind that this calculation assumes that the cost structure remains the same after leaving the job and that the cost of your employer-sponsored health insurance didn't change.

Find Box 12

On the W-2 form of the individual who was paying for the health insurance, Box 12 with Code DD represents the total cost of employer-sponsored health coverage. This amount includes both the part of the cost paid by that individual and the part paid by their employer. It can serve as a valuable starting point to determine the monthly COBRA cost for continuing coverage.

Here's how you can use that information:

- Locate Box 12, Code DD on Your W-2: Find the amount listed under this code. This is the total annual cost of your health coverage.

- Divide by 12 for the Monthly Cost: Take the annual cost and divide it by 12 to find the monthly cost of your health insurance when you were employed.

- Add the Administrative Fee: COBRA allows for an administrative fee, usually up to 2% of the total premium cost. Calculate this fee and add it to the monthly cost.

Example:

- Box 12, Code DD Amount: $12,000 (annual cost)

- Monthly Cost Without Fee: $12,000 / 12 = $1000

- Administrative Fee: $1000 * 2% = $20

- Total Monthly COBRA Cost: $1000 + $20 = $1020

How Employers Calculate Health Insurance Costs for Employees

Employers negotiate group health insurance prices by discussing terms with insurance providers, considering factors such as the number of employees, overall health risks, and desired coverage levels. Once an agreement is reached, employers determine the cost to employees by assessing the company's budget, the negotiated premium, and any intended subsidies. This cost is then often divided among employees, factoring in their pay grade, role, or tenure, resulting in a specified monthly premium deducted from their salaries.

The objective is to strike a balance between offering competitive benefits and managing the company's financial health.

As a result of these factors, your COBRA premium will typically be higher than the amount previously deducted from your paycheck. Based on plan and state, COBRA costs range from about $400 to $700 per month and are based on the following:

- Your previous monthly insurance contribution.

- Your recent employer’s monthly insurance contribution. Along with your portion, this amount represents your group health plan’s full monthly premium previously paid to your insurance carrier.

- An administration fee of up to 2%, added for managing your COBRA plan.

Frequently Asked Questions

Schedule A Consult

We can help you find an affordable health plan before your next major medical health coverage begins.

Schedule Call / Add To Calendar – Choose Date And Time